Content

Their operations are much more profitable than any of its peers, which will also result in more profits. We can see the TIE ratio for Company A increases from 4.0x to 6.0x by the end of Year 5.

- If the TIE ratio is 1, then the company will break even after debt expenses, but if the ratio is 2, they can pay off their debt twice over.

- Just like any other accounting ratio, it is best advised not to compare your score against other businesses but only with those who are in the same industry as you.

- These interest payments are categorized as fixed and ongoing expense since they are usually prolonged.

- Principal PaymentsThe principle amount is a significant portion of the total loan amount.

- Along these lines, this proportion is a significant measurement for leasers of an organization.

Just like with most fixed expenses, if a firm is not able to make payments, it could lead to bankruptcy and, thus, to the company’s end. However, sometimes it’s considered a solvency ratio too, and that’s because it can estimate how able a company is to make interest and debt service payments. Interest payments are treated as a fixed expense that’s ongoing, considering they are, most of the times, made for the long-term. In other words, the time interest earned ratio allows investors and company managers to measure the extent to which the company’s current income is sufficient to pay for its debt obligations.

Times Interest Earned Ratio Formula

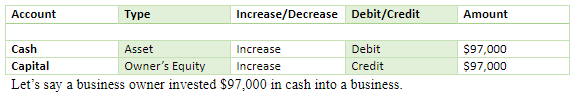

The Times Interest Earned Ratio measures a company’s ability to service its interest expense obligations based on its current operating income. Earnings Before Interest and Taxes is basically a company’s revenue before deducting expenses due to income tax or debt interest payments. As mentioned earlier, the TIE ratio is calculated using a formula, this is simple to learn or calculate. The calculation involves dividing the total earnings of the business before taxes and interest payment by the interest expense. As you can see from this times-interest-earned ratio formula, the times interest earned ratio is computed by dividing the earnings before interest and taxes by the total interest payable. In a nutshell, it’s a measure of a company’s ability to meet its “debt obligations” on a “periodic basis”.

A positive EBITDA, however, does not automatically imply that the business generates cash. EBITDA ignores changes in Working Capital , capital expenditures , taxes, and interest. However, as your business grows, and you begin to turn to outside resources for funding opportunities, you’ll likely be calculating your times earned interest ratio on a regular basis. While 4.16 times is still a good TIE ratio, it’s a tremendous drop from the previous year. While Harold may still be able to obtain a loan based on the 2019 TIE ratio, when the two years are looked at together, chances are that many lenders will decline to fund his hardware store. That means that, in 2018, Harold was able to repay his interest expense more than 100 times over.

Examples Of Times Interest Earned

If your business has debt and you are looking to take on more doubt, then the interest coverage ratio will provide your potential lenders with an understanding of how risky a business you are. It will tell them whether you would pay back the money that they are lending you. Usually, a higher times interest earned ratio is considered to be a good thing. But if the balance is too high, it could also mean that the company is hoarding all the earnings without putting them back into the company’s operations. For sustained growth for the long term, businesses must reinvest in the company. This means that Tim’s income is 10 times greater than his annual interest expense.

What is a good PB ratio?

A PB ratio of 1 is a good PB ratio for stocks. However, PB ratio up to 3 is acceptable. How to use PB ratio to discover an overvalued stock?

Thus, the time’s interest earned ratio measures the solvency of a corporation within the future. Times interest earned time interest earned ratio formula formula is one of the most important formulas for the creditors in order to find out the credit health of a company.

Analyzing Investments With Solvency Ratios

A company with a low ratio is at credit risk and will find obtaining a loan difficult. However, for a company with a high and stable ratio, there is room for growth as financial institutions and creditors will be willing to provide loans.

These 4 Measures Indicate That AMERCO (NASDAQ:UHAL) Is Using Debt Reasonably Well – Nasdaq

These 4 Measures Indicate That AMERCO (NASDAQ:UHAL) Is Using Debt Reasonably Well.

Posted: Mon, 29 Nov 2021 17:52:01 GMT [source]

Startup firms and businesses that have inconsistent earnings, on the other hand, raise most or all of the capital they use by issuing stock. Once a company establishes a track record of producing reliable earnings, it may begin raising capital through debt offerings as well. The formula for TIE is calculated as earnings before interest and taxes divided by total interest payable on debt. The companies with weak ratio may have to face difficulties in raising funds for their operations. It helps to evaluate how many times a firm’s operating income i.e. earnings before interest and taxes may settle the firm’s interest expense. At the point when the premium inclusion proportion is littler than one, the organization isn’t producing enough money from its activities EBIT or EBITDA to meet its advantage commitments.

Income before interest and tax (i.e., net operating income) and interest expense figures are available from the income statement. Let’s say that the Times Interest Earned ratio is 3; that’s an acceptable risk for the investors. Businesses that have a times interest earned ratio of less than 2.5 are considered to be financially unstable. A company that uses debt only for a small part of its capital structure will show a higher times interest earned ratio. On the other hand, a company that uses a large amount of its capital as debt will have a low times interest earned ratio because of the high interest rates that they would incur. When the company has a high TIE ratio, it means that the company is in good hands.

Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts. In this exercise, we’ll be comparing the net income of a company with vs. without growing interest expense payments. Now, to see an example calculation of the times interest earned ratio, use the form below to download the file. The equity versus debt decision relies on a large number of factors such as the current economic climate, the business’ existing capital structure, and the business’ life cycle stage, to name a few. On the other side, it is essential to bear in mind, that EBIT is highly impacted by accounting standards and principles applied.

Times Interest Earned Ratio

For purposes of solvency analysis, interest payments and income taxes are also listed separately from the usual operating expenses. The capitalization of a company is the amount of money it earned by selling stock or debt and those options have an effect on its TIE ratio.

James Chen, CMT is an expert trader, investment adviser, and global market strategist. Debt capacity refers to the total amount of debt a business can incur and repay according to the terms of the debt agreement.

The times interest earned formula was developed to help lenders qualify new borrowers based on the debts they’ve already accumulated. It’s a worthwhile measure to ensure companies keep chugging along and only take on as much as they can handle. One goal of banks and loan providers is to ensure you don’t do so with money, or, more specifically, with debts used to fund your business operations.

Capitalization Ratio

Your segment head has asked you to do some preliminary ratio analysis to assess whether the companies’ financial strength is good enough to warrant detailed cash flows based analysis. This ratio is known by various names such as debt service ratio, fixed charges cover ratio and Interest coverage ratio. In case times interest earned ratio is less that 1, this is an indication that the business does not earn sufficient profit from its activities to enable it paying interest costs. SMD Utilities Company is a successful and stable company, providing essential services that render consistent earnings.

Interest Coverage Ratio Definition – Investopedia

Interest Coverage Ratio Definition.

Posted: Sun, 26 Mar 2017 07:41:07 GMT [source]

Financial ratios quantify many aspects of a business and are an integral part of the financial statement analysis. Financial ratios are categorized according to the financial aspect of the business which the ratio measures. All accounting ratios require accurate financial statements, which is why using accounting software is the recommended method for managing your business finances. It means that the interest expenses of the company are 8.03 times covered by its net operating income .

Times Interest Earned Ratio Video

A higher discretionary income means the business is in a better position for growth, as it can invest in new equipment or pay for expansions. It’s clear that the company’s doing well when it has money to put back into the business. The times interest earned ratio measures a company’s ability to pay its interest expenses.

Is 30 a good PE ratio?

A P/E of 30 is high by historical stock market standards. This type of valuation is usually placed on only the fastest-growing companies by investors in the company’s early stages of growth. Once a company becomes more mature, it will grow more slowly and the P/E tends to decline.

The Times Interest Earned ratio is calculated by dividing a company’s earnings before interest and taxes by its periodic interest expense. It is usually expressed as a ratio and the numbers necessary to calculate the interest coverage ratio. If a company’s TIE ratio is a higher number, it indicates the company can cover the expenses it accrues in debts and debt interest. Lenders and investors regard a TIE ratio greater than 2.5 as being an acceptable credit risk. A TIE ratio of 2.5 or above also shows that a company is more likely to pay off its debts consistently over the long-term. As you can see, creditors would favor a company with a much higher times interest ratio because it shows the company can afford to pay its interest payments when they come due.

Relevance And Uses Of Times Interest Earned Formula

Like most ratios and measurements, there are high times interest earned ratio and low times earned interest ratio. The importance and the best for a company of these levels will also be discussed. This ratio can be used for the measurement of a company’s financial benchmarks and position. As obvious, a creditor would rather prefer a company with a high times interest ratio. Such a ratio can indicate the fact that the firm is able to afford the interest payments by the due date. Moreover, a higher ratio doesn’t have as many risks as a low one does, as the latter one brings credit risks. Also called the interest coverage ration sometimes, the times interest earned ratio is a coverage ratio.

If the water is filling your glass faster than you can drink it, it’s fair to say you should not be given more — more debt means more interest. In the end, you will have to allocate a percentage of that for your varied taxes and any interest collecting on loans or other debts. Your net income is the amount you’ll be left with after factoring in these outflows. Any chunk of that income invested back in the company is referred to as retained earnings. Generally, a ratio of 2 or higher is considered adequate to protect the creditors’ interest in the firm. A ratio of less than 1 means the company is likely to have problems in paying interest on its borrowings.

A much higher ratio is a strong indicator that the ability to service debt is not a problem for a borrower. The times interest ratio is stated in numbers as opposed to a percentage. The ratio indicates how many times a company could pay the interest with its before tax income, so obviously the larger ratios are considered more favorable than smaller ratios. A high TIE means that a company likely has a lower probability of defaulting on its loans, making it a safer investment opportunity for debt providers. Conversely, a low TIE indicates that a company has a higher chance of defaulting, as it has less money available to dedicate to debt repayment.

Learn financial modeling and valuation in Excel the easy way, with step-by-step training. You recently received applications from two FMCG companies, A & B, for 5-year financing. They would like to take on more debt to expand their services to a more extensive customer base. If possible, verify the text with references provided in the foreign-language article. QuickBooks Online is the browser-based version of the popular desktop accounting application. It has extensive reporting functions, multi-user plans and an intuitive interface.

Businesses calculate the cost of stock and debt capital and use the cost to make decisions. The ratio of interest received times shows to what extent profits are available to cover interest payments.

The actual value of TIE ratio should also be compared with that of other companies working in the same industry. Let’s consider the example above and assume the industry average in the current year is 3.425. If the TIE ratio is 1, then the company will break even after debt expenses, but if the ratio is 2, they can pay off their debt twice over. Hence, as proven above, the TIE ratio provides a business with its financial state. For a business with a TIE ratio of 4, obtaining more assets that can increase productivity is a good move. This is a measure of how well a firm can cover interest costs with its earnings. This company should take excess earnings and invest them in the business to generate more profit.

It shows how many times the operating profit of a company from its business operations is able to cover the total interest expense for the company in a given period of time. Times interest earned ratio is a kind of solvency ratio as the major part of the total interest come from long term debt for the company.

Author: Justin D Smith